Alicja

I used to buy food from a small high street shop - I only realised I was overpaying for fruit & veg when a friend took me to a local market! Now I visit several places every week to buy good quality food at a lower price.

You are currently offline

Scroll down the page to view the next sections: 'Household bills' and 'Travel and shopping costs'.

Key information

1. You will spend most of your income on rent, transport, bills and food

In London, people spend up to 75% of their income on housing, rent and bills. Public transport is really efficient and well-developed but it is also more expensive than in most other European countries. Explore this section to learn ways to keep your costs down.

2. Make a plan for your monthly outgoings to manage your money

It’s easy to lose track of payments. Making a list of what bills you need to pay and when can help you manage your money. There are local organisations (listed in this section) who can help you do this and online budget planners such as the Money Advice Service.

3. Check if you can reduce your household bills

Some people get discounted rates for household bills like ‘Council tax’, gas, electricity, and water. Read more in this section and learn about local organisations who can advise you further. Tips to reduce all household bills include:

- Paying by monthly direct debit in place of individual card or cash payments

- Paying on time to avoid late payment fees

4. Get advice and support from local organisations to help you manage your money

British systems can be complex to understand and navigate - don’t struggle alone when you don’t need to. We all reach out to local organisations for support from time to time. The local organisations listed in this section will give you free and confidential advice.

5. Choose where you shop wisely to keep your costs down

Larger supermarkets are usually cheaper than smaller convenience stores and provide a greater choice of produce. Here are some top tips:

- Aldi, Lidl, Iceland and Morrisons supermarkets offer the lowest prices

- You can buy cheaper produce in local street markets and ‘Pound stores’

- Look out for discounts, offers and reward schemes

6. Choose your travel and payment options with care to reduce costs

- Trains vs. buses - a single train ticket costs more than a bus ticket, and varies in price depending on the distance and time of travel. Buses have a fixed fare of £1.50, with unlimited journeys within one hour

- ‘Pay as you go’ vs. single tickets - single paper tickets cost more than ‘pay as you go’ using an Oyster or Contactless bank card

Household bills

Aside from rent or mortgage payments, every household has bills that are usually paid monthly. Tips to reduce all household bills include:

- Paying by monthly direct debit in place of individual payments

- Paying on time to avoid late payment fees

Rental costs

Rental costs are generally expensive in London, but they vary depending on where you live and the size of your home. The average monthly rent for a 2-bedroom home in Haringey is £1500-2000. Some people have to pay an additional ‘service charge’ to their landlord to cover the costs for building services, repairs and insurance.

Household bills

If you’ve moved into a rental property, check your ‘tenancy agreement’ carefully as some bills may be included with your rent. You should also ask your landlord for the names of providers so you may register with them (e.g. Haringey Council for ‘Council tax’). Here are some general tips when paying bills:

-

Your payment options

They include direct debit, single payment using a debit / credit bank card, cheque and electronic bank transfer

-

Paying online is quick and convenient

You usually need to register with providers before you can use this service

-

Pay your bills (excluding 'Council tax') in person at a local ‘PayPoint’ store

You can pay by cheque, cash or debit/ credit bank card. Centres are found in local Post Offices and shops displaying the PayPoint sign. Find your local store by entering your postcode online here.

-

Get support when needed

If you need help to register with providers or want to find out more about reducing your bills, get in touch with your provider or a local support organisation like Citizens Advice (read more below).

Essential bills

-

‘Council tax’

What is it?

A tax paid to Haringey Council to fund services in their local area e.g. rubbish collectionHow much does it cost?

The monthly cost is £80-140. Your property has a ‘tax band’ from A (cheapest) to H (most expensive) depending on where you live and the type of home you live in. Check your tax band by entering your postcode online here.How can I pay it?

Register first by completing information online here or by downloading and printing a form here. You can pay monthly:- Online

- By phone

- In person at Haringey Council self-service kiosks

Can I reduce the costs?

Some people can get help to cover partial or full costs e.g. if you are a student or earn a low income. Read more online here. -

Water

What is it?

The cost of water usage by your householdHow much does it cost?

The average monthly cost for a 2-bedroom flat is £35How can I pay it?

Most people pay monthly:- Online

- By phone

- In person at a PayPoint store

Can I reduce the costs?

Unfortunately, you cannot change water providers but there are other ways to save:- Check if you get a discount - some people get a discount, for example if they have a low income

- Check your meter type and switch to a metered bill - some homes are unmetered, where a bill is calculated based on the size of your house. It’s cheaper to have a standard meter where you pay for what you use

-

Gas & electricity

What is it?

The cost of gas and electricity usage by your householdHow much does it cost?

The combined average monthly cost for a 2-bedroom flat is £60How can I pay it?

Most people pay monthly:- Online

- By phone

- In person at a PayPoint store

Can I reduce the costs?

You may have the option to switch to a different company who can offer a better price - ask your landlord if you can make a switch. Here are other ways to save:- Check if you get a discount - some people get a discount, for example if they have a low income or are over a certain age

- Take regular meter readings - at least every 3 months to ensure you pay only for what you use

- Check your meter type and switch to a standard meter - some homes have ‘prepayment’ meters, where you pay before you use energy. It’s cheaper to have a standard meter where you are billed for what you have used.

Non-essential household bills

-

TV licence

What is it?

A legal requirement to watch or record programmes as they are being shown on TV, or in real-time on a tablet, computer or laptopHow much does it cost?

The average annual cost of a colour TV licence is currently £155How can I pay it?

You can pay annually:- Online here

- In person at a PayPoint store

Can I reduce the costs?

You can apply for a free licence if you receive ‘Pension Credit’ (government support) and are aged 75 or older. Care home residents and people who are registered as blind can get a discounted rate. -

Internet & home phone service

What is it?

The cost of home internet and a landlineHow much does it cost?

The average monthly cost is £25. Keep in mind that most providers require you to pay line rental for a landline phone even if you don’t use one!How can I pay it?

Most people pay monthly:- Online

- By phone

- In person at a PayPoint store

Can I reduce the costs?

You have the option to switch to a different provider who can offer a better price -

Home insurance

What is it?

Buildings insurance, which covers the property from things like floods, and Home contents insurance, which covers the belongings inside yourHow much does it cost?

The average monthly cost is £10-20. Check your tenancy agreement as buildings insurance may be covered by ‘service charges’ that you make to your landlordHow can I pay it?

Most people pay monthly:- Online

- By phone

- In person at a PayPoint store

Can I reduce the costs?

Shop around for the best deal when your policy renews each year

Getting help with household bills

It’s easy to miss a bill payment, we’ve all done it from time to time! Make a list of what bills you need to pay and when - this will help you manage your outgoings and avoid late payment fees. You can use online budget planners such as the Money Advice Service, or get in touch with local organisations. They can help you to:

- Manage your money

- Register with providers

- Find out if you can get discounted bills and apply for this

Travel and shopping costs

Aside from housing costs, a lot of our money is spent on shopping and travel. London living costs are high, but there are ways to save.

- Check out our dedicated section ‘Paying for your travel’ for more details about your payment options and money-saving tips

How much does it cost?

-

Food

The average family in the UK spends £45-59 on their weekly food shop

-

Public transport

A person using a ‘Pay as you go’ Oyster or Contactless bank card spends approximately £36 a week to travel in ‘Zones 1-2’ (central London). The cost of your journey depends on where, when and how you travel:

- Bus - a single adult journey costs £1.50 with unlimited bus travel within one hour

- Train / Tube - a single adult train journey during ‘off-peak’ (quieter periods) in central London (‘Zones 1-2’) costs £2.40-2.90

How can I keep my costs down?

Shopping

-

Larger supermarkets tend to be cheaper than smaller, local convenience stores and offer a greater choice of produce

- Aldi, Lidl, Iceland and Morrisons offer the lowest prices

- Iceland sells affordable frozen food including fruit and vegetables

- Some supermarkets like Morrisons offer free home delivery when you shop online

- Waitrose and Marks & Spencers are the more expensive high-street supermarkets

-

Shop in street markets for fresh produce

Keep an eye out for street markets that usually run once or twice a week. They sell good quality vegetables and fruit at a lower price.

-

Buy the basics from ‘Pound stores’

Low cost stores such as Poundland sell a range of items for £1 including food essentials (such as eggs and bread), toiletries, cleaning products, and basic medicines. Take care to check the quality of items before you buy.

-

Look out for discounts and offers

- Buying larger quantities is normally cheaper than smaller packs

- Large supermarkets have loyalty schemes where you can collect points that you exchange for money-off or vouchers

-

Speciality shops can be more expensive than larger supermarkets

There are a number of shops in Haringey that sell produce from other countries such as Poland and Turkey. Check the price carefully as you may find the same item cheaper in the ‘World food’ aisle of larger supermarkets.

-

Some people can get government help to buy healthy foods and vitamins

‘Healthy Start’ vouchers are provided to women who receive certain types of financial support from the government, and who are at least 10 weeks pregnant, or have a child under four years.

- Ask your local doctor (GP) for more information and how to apply

Travel

-

Plan your journey to keep your costs down

Decide how you will pay before you travel as you can’t use cash once on board

- Use a free navigation app to select the cheapest route (Google Maps, CityMapper, Transport for London)

- If you’re travelling a short distance, it may be quicker, cheaper (and healthier!) to walk

- It’s usually cheaper to travel by bus than train

-

Pay as you go’ Oyster and Contactless bank cards are usually cheaper no matter how often you travel

If you make multiple journeys in a day or week, you don’t get charged more than the price of a Travelcard (this is cheaper than adding the cost of each journey).

‘Pay as you go’ is cheaper than:

- Single paper tickets

- Daily Travelcards

-

Train costs are higher the further you travel and at busy times

- Area (‘zone’) of travel - train services across London are divided into nine ‘zones’. It costs more to travel in ‘Zone 1’ (central London) or to cross more than one ‘zone’.

- The time you start your first journey - it’s more expensive to travel during ‘peak’ hours (Monday to Friday, 06.30 to 09.30 and 16.00 to 19.00).

-

Season passes only save you money if you travel frequently

Travelcards and Bus & Tram passes only save you money if:

- You choose weekly, monthly or longer-term options

- and you travel multiple times over that period

-

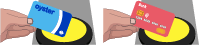

Touch in (and out) using the same Oyster or Contactless bank card

Use the same card to touch the yellow pad reader so the cheapest fare can be automatically calculated:

- Bus travel - at the start of your journey

- Tube/ train travel - at the start and end of journeys, and when changing trains at some stations

-

Some people can get free or discounted travel based on their age or need

Read more about who is eligible and how to apply in our dedicated ‘Paying for your travel’ section. Check if you can get help with travel costs:

- Online - on the TFL website here

- Asking locally - at your local Post Office or Jobcentre Plus (if you get financial help from the government)